idaho military retirement taxes

A veteran or their un-remarried widow age 65 or older or disabled and age 62 or older receiving veterans retirement benefits may deduct those benefits. Learn more about Idaho Retirement Benefits Deduction for Military Retired Pay.

Idaho Military And Veterans Benefits The Official Army Benefits Website

Learn more about Idaho Retired Military Pay Income Tax Deduction.

. The retirement annuities eligible for this deduction on the Idaho State return include. A Military retirement b Civil Service Retirement System CSRS if the account number begins with 0123 or 4 c Idahos firemens retirement fund not PERSI d Policemens retirement fund of an Idaho city not PERSI. Maryland - The first 5000 is tax-free that amount increases to 15000 at age 55.

A new law passed in 2021 will make military retirement tax-free for more than 100000 retirees in five states. Oklahoma - The greater of 75 of your retirement pay or 10000 is tax free. Idaho veteran benefits state that military disability retirement pay received as a pension annuity or similar allowance for personal injury or sickness resulting from active service in the Armed Forces should not be included in.

Idaho residents must pay tax on their total income including income earned in another state or country. Up to 24000 of military retirement pay is exempt for retirees age 65 and older. 100 Service-Connected Disabled Veterans Benefit.

The Veterans Property Tax Reduction benefit reduces property taxes for qualified 100 service-connected disabled veterans. As a resident of Idaho all military retirement amounts included in your federal return are also taxable on your Idaho return. Military Disability Retirement Pay received as a pension annuity or similar allowance for personal injury or sickness resulting from active service in the US.

The credit is the smaller of. Armed Forces should not be included in taxable. State Income Tax Retired Military Pay Benefit Deduction.

The Idaho Retirement Benefits Deduction may be available to retirees who are both disabled and receive a qualifying source of retirement income. If you qualify the property taxes on your home and up to one acre of land may be reduced by as much as 1500. Taxpayer is 65 years old or older or.

Feature Ad 728 Iklan Atas Artikel. Part 2 Qualified Retirement Benefits. Still Arizona North Carolina and Utah retirees can stop paying taxes now and the changes are coming.

We Salute our Retirees. Police Officers of an Idaho City. Idaho Military And Veterans Benefits The Official Army Benefits Website 2.

Recipients must be at least age 65 or be classified as disabled and at least age 62. As a service members spouse you may qualify for the federal Military Spouses Residency Relief Act SR 475 HR 1182 which was passed in November 2009. However according to Idaho instructions Idaho allows for a subtraction of retirement income on your state return if the taxpayer meets both parts of the two-part qualification that the state requires.

To make this. This guide lists some resources that can be useful to Idaho senior citizens and retirees. 2014 Military Retired Handbook State Tax Info 2015 Space A Travel Retiree.

Idaho residents stationed outside of Idaho Active duty military income earned outside of Idaho by an Idaho resident is not subject to Idaho income tax. Newer Post Older Post Home. State Income Tax Retired Military Pay Tax Deduction.

When stationed outside the State of Idaho active duty personnel are exempt from Idaho state income tax. A new law passed in 2021 will make military retirement tax-free for more than 100000 retirees in five states. Idaho considers the following individuals to be disabled.

Idaho Tax Exemption for VA Disability Retired Pay. To make this manual entry go to. Overview of Idaho Retirement Tax Friendliness.

The program doesnt have an income limit. Residents of two states will have to wait until next year to stop paying taxes on their military retirement. Part-year residents must pay tax on all income they receive while living in Idaho plus any income they receive from Idaho sources while living outside of Idaho.

States That Don T Tax Military Retirement Turbotax Tax Tips Videos Share this post. Tax-free if stationed out-of-state. Banking Jan 18 2022.

However not all of that investment. Tax free for for retirees over 65 disabled retirees over 62. Veterans and unremarried surviving spouses aged 65 or older or disabled and age 62 or older who receive military retirement benefits are permitted to deduct those benefits at state tax time.

File Form 43 if your gross income from Idaho sources exceeds 2500. The Act exempts you from paying income tax if. Idaho State Taxes on Military Disability Retirement Pay.

An individual who is recognized as disabled by the Social. Object Moved This document may be found here. The men and women of the Idaho National Guard extend our deepest gratitude for your military service to our great state and nation.

If you are a nonresident of Idaho stationed in Idaho if your military home of record isnt Idaho and you were on active duty stationed in Idaho for all or part of the year Idaho doesnt tax your military income. Iklan Tengah Artikel 1. Idaho military retirement taxes Tuesday 15 March 2022 Edit.

Nonmilitary income from Idaho sources is subject to Idaho tax. The deductible must be reduced by retirement benefits paid under the Federal Social Security Act. We also thank you for helping to shape the Idaho National Guard into the great organization that it is today.

That is a 10 rate. The full-time duty must be continuous and uninterrupted for 120 consecutive days or more. Does Idaho Tax Pensions.

Tax free for for retirees over 65 disabled retirees over 62. State Income Tax Exemption. Your retirement income must come from one of the following.

The military income earned by an Idaho resident stationed in Idaho is subject to Idaho income tax. Youre married to a service member whos serving in Idaho and has registered in the military with another state as a home of record.

States That Don T Tax Military Retirement Pay Discover Here

The States That Won T Tax Military Retirement In 2022

Idaho Military And Veterans Benefits The Official Army Benefits Website

Veteran Benefits For Idaho Veterans Guardian Va Claim Consulting

Your 2022 State Veteran Benefits Military Com

These States Don T Tax Military Retirement Pay

The Top 12 Idaho Veteran Benefits For 2022 Va Claims Insider

Idaho Military And Veterans Benefits The Official Army Benefits Website

Idaho Military And Veterans Benefits The Official Army Benefits Website

Idaho Retirement Tax Friendliness Smartasset

List Military Retirement Income Tax

Senator Eyes Tax Exemption For Military Retirement Social Security Nebraska News Journalstar Com

State By State Guide To Taxes On Retirees

Idaho Military And Veterans Benefits The Official Army Benefits Website

Idaho Retirement Tax Friendliness Smartasset

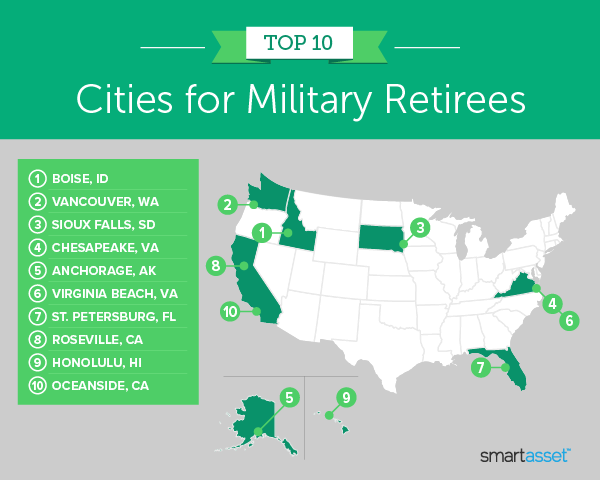

Best Cities For Military Retirees 2021 Study Smartasset

States That Don T Tax Military Retirement Pay Discover Here

These Five States Just Eliminated Income Tax On Military Retirement

Top 10 Best States For Disabled Veterans To Live 100 Hill Ponton P A